Bank routing number is a nine-digit number used to identify a financial institution's trading. The most common type of transaction is ACH and wire transfers. Some banks and credit unions may have many different uses, geographic or branch of service routing number. They can also be found online banking websites of financial institutions. The SWIFT Code is a standard format for Business Identifier Codes that is used to uniquely identify banks and financial institutions globally.

These codes are used when transferring money between banks, especially for international wire transfers or SEPA payments. When 8-digits code is given, it refers to the primary office. When transferring money in Europe, you will often be asked for a SWIFT/Bic number.

The Fedwire Wire Transfer service is the fastest way to transfer funds between business accounts and bank accounts in the USA. It is used for domestic or international transactions in the US, where the account balance is directly debited electronically and the funds are transferred to an account in real time. A routing number is a nine digit code, used in the United States to identify the financial institution. Routing numbers are used by Federal Reserve Banks to process Fedwire funds transfers, and ACH direct deposits, bill payments, and other automated transfers.

A Routing Number enables Federal Reserve Banks to process Fedwire funds transfers, and to process bill payments, deposits, and other transfers via the Automated Clearing House. Routing numbers are necessary when bank customers are paying bills by phone by using a check, when reordering checks or when a bank account holder sets up a direct deposit. A SWIFT code is used instead of a routing number for international wire transfers. Deposit products offered by Wells Fargo Bank, N.A. Member FDIC. LRC-1120.

It is a unique identification code for business, mostly financial institutions. Some financial institutions have more than one Swift Codes for different purposes. Also known as banking routing numbers, routing transit numbers, RTNs, and SWIFT codes. Routing numbers are different from checking and savings accounts, prepaid cards, IRAs, lines of credit, and wire transfers. The American Bankers Association routing numbers are solely used for ACH transfers. Domestic wire transfers must only be completed through local ACHs within a day.

In the country of the receiving bank, international wire transfers must also clear an ACH that adds to the procedure another day. Factors like holidays at banks, time zones, weekends, and mistakes in detail may delay wire transfer. It is also essential that account numbers and bank codes be checked before a wire transfer is completed. Domestic wire transfers in the US, however, communicate transaction instructions through CHIPS or Fedwire networks.

On the other hand, international wire transfers use SWIFT, a network of more than 10,000 banks and financial institutions across 200 countries. The ABA routing numbers are useful only for ACH transfers. Your Wells Fargo bank routing number will be unique to the area where you opened your account. ACH Routing Numbers is an acronym for for Automated Clearing House routing numbers. This number is used for America electronic financial transactions. The first four digits identify the Federal Reserve district in which the bank is located and the following four numbers identify the bank.

The last number is referred to as a check digit number, which is a confirmation number. ACH Routing Numbers are used for direct deposit of payroll, federal and state tax payments, dividends, annuities, monthly payments and collections. International wire transfer is a popular way to receive money from foreign countries. All Banks use the SWIFT network for performing international wire transfers. US banks use the same CHIPS and Fedwire systems to process international wire transfers.

Instead, they send wire instructions using the Society for Worldwide Interbank Financial Telecommunications codes instead of the local bank routing number. SWIFT is a worldwide non-profit organization consisting of over 9,000 institutions. Routing numbers are also known as "Check Routing Numbers", "ABA Numbers", or "Routing Transit Numbers" .

The ABA routing number is a 9-digit identification number assigned to financial institutions by The American Bankers Association . The number determines the financial institution upon which a payment is drawn. Each routing number is unique to a particular bank, large banks may have more than one routing number for different states.

Routing numbers may differ depending on where your account was opened and the type of transaction made. Wells fargo bank colorado n a routing number is a nine digit number used to identify bank transfers. Routing numbers will be different based on the account branch. It is based on the bank account origin by state and region. The routing number on check is available for each branch in the table below.

Swift Code ( also known as SWIFT – BIC or BIC Code) is a Code assigned to a bank or its branches for online cash transactions or wire transfer across the world. Look up the swift codes of Wells Fargo Bank in the following list. All the swift codes given below are connected to the Swift Network.

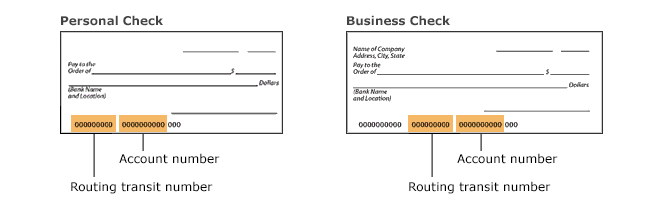

Routing numbers are used by financial institutions as a way to easily identify the transference of funds between accounts. The specific routing number of a bank will always be located in the bottom-left hand corner of a check, directly to the left of the account number, as seen in the image below. A SWIFT Code is a standard format of Bank Identifier Code used to specify a particular bank or branch.

These codes are used when transferring money between banks, particularly for international wire transfers. Banks also use these codes for exchanging messages between them. If you are looking for Wells fargo bank routing number for wire transfer, then you are at right place. Here, we are going to full list of Wells fargo bank routing number with address. Usually, the exact routing number is close to the bottom of the cheque, where you can identify the financial institution in which it is designed.

The check number, sometimes called the ABA number or SWIFT code, can manage an account and transfer money from one bank account to another. Routing numbers differ for checking and savings accounts, prepaid cards, IRAs, lines of credit, and wire transfers. All banks usually have separate routing numbers for each of the states in the US. The best bank accounts for kids include features that help you teach them about money management, earning interest, and more.

Here are the details regarding some of the best checking and savings accounts for getting your kids on the path to great money management in adulthood. A routing number, also called the ABA routing transit number , is a nine-digit code that indicates the financial institution you bank at. They are unique to each bank and allow the accurate transferring of money between financial institutions.

You need to know your routing number to connect online accounts to your bank account, set up direct deposit with your employer, and in many other financial situations. Incoming and outgoing international wire transfer costs depend on the provider, destination, transaction amount, and the mode of sending money. They can also cost more if you choose to use Wells Fargo's foreign currency exchange service.

Now you'll see the routing number for direct deposits, electronic payments, and domestic wire transfers. The routing number for domestic and international wire transfers for Wells Fargo are the same across all states. The checking and saving account routing number and the ACH routing number for Wells Fargo varies state by state, you can find these in the table above. There are several routing numbers for Wells Fargo Bank, National Association reported in our bank database. Get routing numbers for Wells Fargo checking, savings, prepaid card, line of credit, and wire transfers or find your checking account number. You can receive funds to your Wells Fargo account from any bank within USA by using a domestic wire transfer.

Use these details to receive an international wire transfer in your Wells Fargo account. Yes, it does matter what routing number you are using because most of banks use different routing numbers for different types of transactions. So when you are making a particular type of transaction you have to ensure you are using the routing number that is assigned for that transaction type. For example, the routing number printed on your check might not be the exact routing number you need for an ACH transfer or direct deposit. Using a Wells Fargo account in the US to send or receive a domestic or international wire transfer?

Make sure your payment arrives by using the right routing number. A routing number is a nine-digit numeric code printed on the bottom of checks that is used to facilitate the electronic routing of funds from one bank account to another. It's also referred to as RTN, routing transit number or bank routing number. 3 Wells Fargo Bank Branch locations in Santa Maria, CA. Find a Location near you. View hours, phone numbers, reviews, routing numbers, and other info.

Wells Fargo Bank Albertson' Buellton branch is located at 222 East Highway 246, Buellton, CA and has been serving Santa Barbara county, California for over 22 years. Get hours, reviews, customer service phone number and driving directions. Your routing number identifies the location where your account was opened. You'll often be asked for your checking account routing number when you're making a payment online or by phone. It's also referred to as an RTN, a routing transit number or an ABA routing number. You'll likely need your Wells Fargo routing number when managing your finances.

Keep it handy should you need to set up a direct deposit, automatic payment, or wire transfer. Likewise, credit cards do not have routing numbers since they are not directly linked to any bank account. Although your debit card is associated with a bank account, you do not use a routing number for debit card transactions. Routing numbers are only used for transfers directly between bank accounts.

Wire transfers are among the most prevalent methods of financial transfer between local and international banks. Do people or companies interested in making such a transaction may inquire about the difference between domestic and international wire transfers? There is one routing number for Wells Fargo bank accounts in all branches in Colorado. The same ABA routing number is used for both checking and savings accounts and is unique for Wells Fargo accounts in Colorado. WELLS FARGO BANK NA routing numbers have a nine-digit numeric code printed on the bottom of checks which is used for electronic routing of funds from one bank account to another.

There are 20 active routing numbers for WELLS FARGO BANK NA. You can open a new savings account with these online banks' low $100 minimum opening deposit requirement and it's as simple as that. A routing number is a 9-digit code that is assigned to a bank or credit union so that it can make transactions with other financial institutions. When you set up a direct deposit for a new job, your employer will ask you for the routing number and account number from your bank account. When you send a payment overseas, the SWIFT/BIC code is mandatory and identifies the beneficiary bank or financial institution.

If you use the wrong routing number while making a wire transfer then the transfer will be rejected and the fund will be returned to you. Usually, a bank checks the account number, name, and routing number, etc., and if the information doesn't match then the bank cancels the payment. A bank's Routing Transit Number is a 9-digit code used to identify your bank on checks, direct deposit, bill pay, and in other transactions. Wire transfers are a faster way to send money than an ACH transfer. You can make a wire transfer by visiting a Wells Fargo branch. CHIPS Participant0407Before sending a wire transfer, double-check that you have received all of the necessary information.

Wire transfers are practically never reversible for a variety of reasons. Always speak with the individual you are about to send a wire transfer to double-check the details and get their approval. I've heard of several scams that have occurred due to erroneous wire transfer transactions. When you send a Fedwire wire transfer, your bank utilizes a 9-digit ABA routing number to identify the destination's bank. Contrary to CHIPS, Fedwire transfers are nearly instantaneous.

Once the recipient receives a notification, they can withdraw their cash. This number is important to transfer money to other accounts or money to pals. As several financial institutions have various routing numbers, it is crucial to ensure that you use the correct number before starting a transaction.

If you've moved around a lot and still have a Wells Fargo account, it can get tricky to find your routing number. You might need it to set up a direct deposit, get a paycheck deposited, transfer funds, or any number of financial tasks. On this page - we've listed all the Wells Fargo routing numbers for checking accounts and wire transfers. You can also click through to a specific state if you want more information, or check out some other handy tips for finding your Wells Fargo routing number here.

Routing numbers help identify banks when processing domestic ACH payments or wire transfers. You don't need one to make a payment to your friend in France, for example. The ACH routing number will have to be included for sending an ACH transfer to any Wells Fargo bank account.

To send a domestic ACH transfer, you'll need to use the ACH routing number which differs from state to state. The Federal Reserve Banks need routing numbers to process Fedwire funds transfers. The ACH network also needs them to process electronic funds transfers – like direct deposits and bill payments. In the US, banks and other financial institutions use routing numbers to identify themselves. They're made up of 9 digits, and sometimes called routing transit numbers, ABA routing numbers, or RTNs. WELLS FARGO BANK, NA routing number identifies the location where their user's account has been opened.