Chase Bank offers a wide variety of banking, lending, and investment products to its clients. It is the largest financial services company in the U.S., and that shows in its ability to provide products for a range of clients. Chase Bank is suited to a broad spectrum of clients, ranging from students to military veterans and from the average household to private banking relationships. Although its presence may not be robust in every state, customers can open and service accounts online or through its mobile apps. There are several choices when opening a checking account.

The accounts do have monthly service fees, but they can be waived when you meet minimum balance requirements or by completing qualifying activities. Premium checking accounts also earn interest and waive some banking fees. Chase Bank has the resources to offer a wide range of choices for businesses and consumers. If you earn at least $500 per month, there's a good chance that you can use a checking account at Chase Bank with no monthly fee. You can also choose from a variety of credit cards that help you make the most of your spending. Chase Bank's technology makes it easy to manage your accounts, and you can move money to other banks at no charge.

Plus, you have access to branches in major metropolitan areas. The basic monthly fee for a Chase saving account is $5. However, saving account fees are waived if you have a savings account that is tied to a Premier Plus or Premier Platinum checking account. You can also get the saving account fees waived if you have a minimum daily balance of $300 or more or if you have an automatic repeating transfer of $25 or more into the savings account each month. If you have a Chase savings account and you are under 18 years old, there is no monthly service fee.

However, you'll pay a $25 monthly fee if you can't keep a $15,000 balance in all of your Chase bank accounts and partner investment accounts combined. Perks.Premium checking accounts offer perks you'd typically have to pay for, such as a no fee safe deposit box, checks, official checks, money orders or waived out-of-network ATM fees. Rewards checking accounts allow you to earn points or cash back through purchases with your debit card. Other types of checking accounts may offer lower mortgage interest rates or financial guidance.

Once your application has been approved, you'll need to fund your account. If you're opening it at a physical branch, you can use a personal check linked to another checking account or cash. If you're processing the account online, you can link a debit card or checking account number to do a bank transfer, or you can use a non-Chase credit card to fund up to $500. As you might expect from a depository institution of its size, Chase Bank offers an extensive menu of accounts and services. Customers have access to multiple checking accounts, savings accounts, certificates of deposit , credit cards, and other lending products to meet their needs. The bank rewards customers who have multiple Chase products with better pricing and the ability to combine balances to waive fees.

The monthly service fee for a Total Checking account is $12, but there are ways that you can get that service fee waived. Total Checking requires a minimum deposit of $25 to open an account. That $12 fee is cut in half for students currently enrolled in high school or college.

Total Checking account holders pay no Chase ATM fees at any in-network ATM and deposits can be made at in-network ATMs as well. Total Checking account holders also have full and free access to Chase's online banking and online bill paying features. Debit cards allow consumers to make safe and convenient transactions with funds from their checking account. Debit cards are often provided when you open an account at a bank, credit union, or financial institution, but there might be some cases in which you have to request one yourself. You may also follow some of the same options if you need to request a replacement for a damaged or lost debit card.

Before committing to opening a bank account and getting a debit card, be sure to consider the monthly service fees that may apply to your savings or checking account. Whether you're just starting college or have been hitting the books for a few years, if you don't have a checking account, it's a good idea to set one up. Checking accounts make it easy to handle your personal finances, including check deposits, bill payments and making online purchases. It's also safer to carry around a debit card instead of cash — if the former gets stolen, you can immediately shut down the card to prevent further losses.

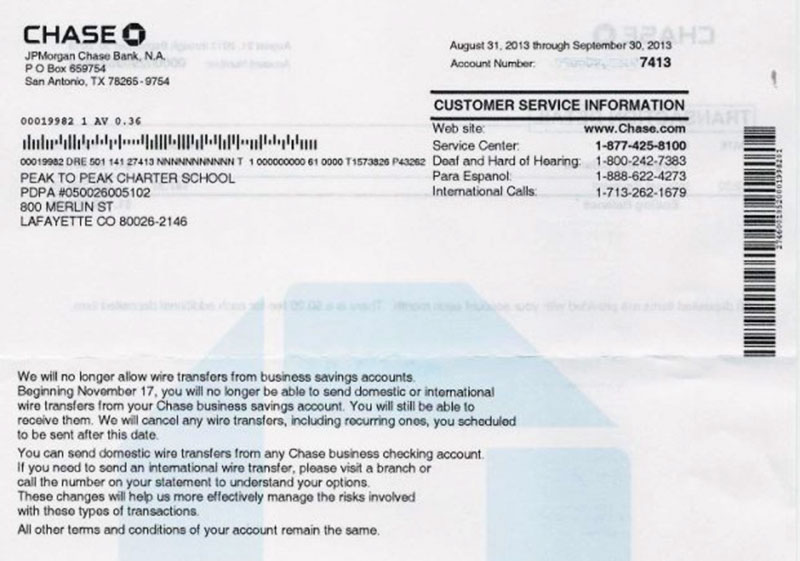

Chase also offers additional niche checking accounts that cater to specific audiences. The Chase Secure Banking checking account has no minimum deposit, no paper checks, and does not charge for money orders or cashier's checks. Active and veteran members of the military can open a Chase Premier Plus Checking account with no fees or minimum balance requirements. Transaction Fees will not be charged for all electronic deposits and the first 250 debits and non-electronic deposits each statement cycle. There will be a Transaction Fee of $0.40 for each debit and non-electronic deposit above 250.

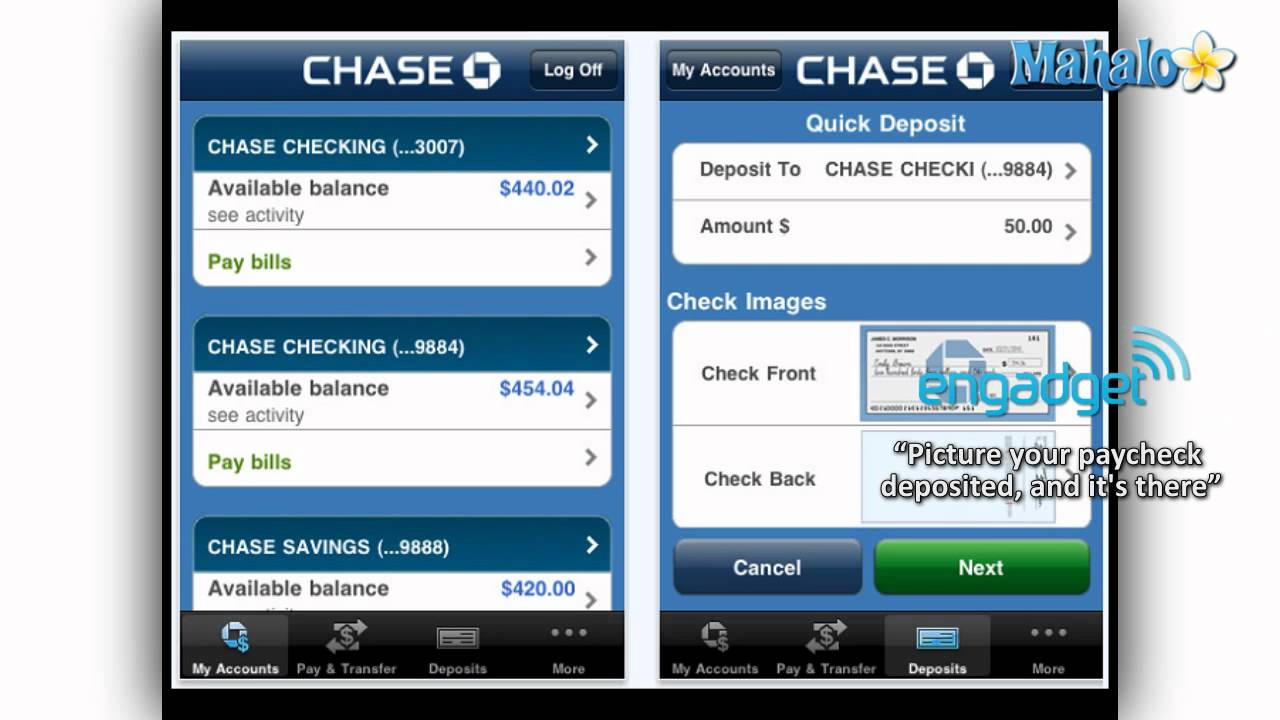

Electronic deposits are deposits made via ATM, ACH, Wire and Chase QuickDeposit. The first $20,000 in cash deposits per month with no fee (standard cash deposit fees apply above $20,000). Fees and product features are subject to change at any time.

Linking for pricing purposes will not affect your statement and does not link account for overdraft protection. Savings accounts don't offer as much access to your money as checking accounts. Federal regulations normally limit you to six withdrawals or transfers per month. Due to the coronavirus pandemic, the Federal Reserve has lifted this restriction, allowing banks to suspend the six-transaction limit, but banks can still charge for "convenience" withdrawals.

And, typically a debit card will not be attached to your savings account, making it more inconvenient to access your money, but cards can normally be used to access savings funds at the ATM. While this makes it easier to save, it means you have to plan ahead when plotting out your monthly expenses. See our Chase Total Checking ® offer for new customers. Learn about our checking services including direct deposit and to order checks. You can also avoid paying the fee with a combined daily average of $5,000 across all your Chase accounts. For people who want to earn interest on their money, there is the Chase Premier Plus checking account.

This account has a higher service fee of $25 per month. The current interest rate paid on the balance of the account is 0.01% although that does change. The minimum amount required to open a Premier Plus checking account is $25. Those who have the Premier Plus checking account also can use any of Chase's in-network ATMs for free and get 24-hour online banking access and online bill pay as well as Chase customer service. Chase Total Checking® is a good option if you want a basic checking account, because it's easy to waive the $12 monthly service fee. You just have to electronically deposit $500 per month, start each day with a $1,500 balance, or maintain a daily average balance of $5,000 in all of your Chase accounts.

More convenient than cash and checks — money is deducted right from your business checking account. Make deposits and withdrawals at the ATM with yourbusiness debit card. It also has multiple credit card options for businesses and consumers alike, including some of the top travel rewards credit cards and cash back credit cards on the market.

If you're a landlord who needs to cash security deposit checks on the go, for instance, this is a lifesaver. The mobile check scanning app is free to use; for higher deposit volumes, you'll want a check scanner, which requires a contract and $25 to $50 monthly fee. Only you can decide if you'd like to become a Chase customer. If you decide you'd still like some cash in your pocket, it's easy to withdraw money from your account at any time with an ATM machine or by getting cash back during purchases. For the most part, the Chase Total Checking account doesn't offer a lot of valuable features. It's a basic checking account that requires you to jump through some hoops to get the monthly fee waived.

But if you can easily qualify to get that fee waived, Chase Total can be worth it to have the benefits of a national bank with branch locations in nearly every state. Furthermore, this Chase account is worth considering because of the $225 bonus — it's easy to qualify for, especially compared to a lot of other bank account bonuses. Chase Total Checking accounts have a $12 monthly fee for everyone except students.

Students pay a Chase monthly checking account fee of $6. Total Checking account fees can be waived if you have a daily balance of $1500 or more. You can also get the monthly fee waived if you have more than $500 in Direct Deposits each month into the account. The third way to avoid paying the monthly fee is to maintain $5000 or more in deposits or investments across several Chase accounts. Some checking accounts require you to pay service fees. Usually, there are ways to get these waived — like setting up a direct deposit for your paycheck if you have a job.

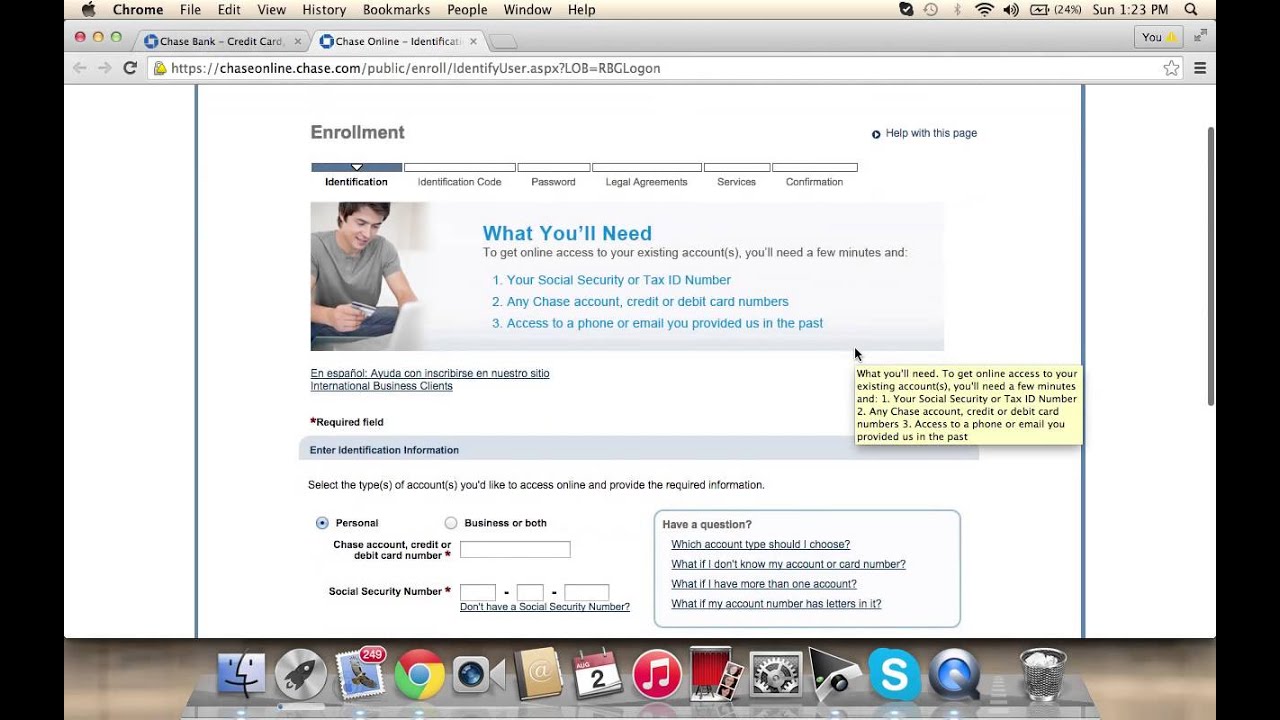

If you're a college student, look into opening a college checking account where the service fees are waived while you're in school. 360 Checking is a checking account that comes with everything you need and without everything you don't. Pay your bills, get cash, make deposits, and transfer money–all without monthly fees and extra trips to the bank. You can open a checking account online and manage your account securely by signing in on your phone or computer, instead of waiting for the bank to open first. And if you ever need help with your account, a real person is just a phone call away. Chase does offer many different checking accounts at different levels.

The more premium-level accounts with the higher monthly fees come with more perks, but even these are relatively dull. But if you didn't meet the monthly fee waiver requirements, you'd be paying up to $300 per year for all of that — not a great bargain. With the NBKC business savings account, you'll earn an APY of .10%.

Additionally, your account will include up to six monthly withdrawals, free online and mobile banking with eStatements, $0 transaction fees, $0 check deposit, and $0 incoming domestic wires. If you want to send an outgoing domestic wire, however, you'll have to pay a $5 per wire fee. International wires, either outgoing or incoming, will also cost a fee—$45 per wire. With BlueVine, you can open a business checking account online—and earn 1% interest on all balances over $1,000. In addition, the BlueVine business bank account is completely free, has no minimum opening deposit requirement, no NSF fees, no incoming wire fees, and includes two free checkbooks.

Customers with larger relationships may qualify for Chase Private Client. To qualify, you'll need an average daily balance of $250,000 combined among your qualifying personal and business deposits and investments. As a benefit, there are no membership fees, monthly service charges, ATM fees, wire fees, and more. Additionally, you'll receive higher limits on Chase QuickDeposit, Chase QuickPay, daily ATM withdrawals, and debit card purchases.

Popular credit cards with well-known brands – Chase offers a total of 30 credit cards from which to choose, 24 personal ones and six for small businesses. There are a variety of credit card options, depending upon your goal of cash back, travel rewards, or balance transfer. • Some features are available for eligible customers and accounts only.

Any time you review your balance, keep in mind it may not reflect all transactions including recent debit card transactions or checks you have written. A qualifying Chase transfer account is required to transfer funds via text. Open a new Chase College Checking account online or in a branch. Complete at least 10 qualifying transactions within 60 days of account opening. Qualifying transactions are debit card purchases, online bill payments, checks paid, Chase QuickDeposit℠, Chase QuickPay with Zelle®, or direct deposits. Chase College Checking account is open to college students who are years old.

The Chase Total Checking® account offers a $225 bonus for new customers and a top-rated mobile app that makes banking easy. With both physical and online banking options, you can tailor your experience to your needs. Chase Total Checking ranks on our list of best checking account bonuses of 2021 because, in addition to the signing bonus, there is no minimum balance requirement to open a new account. In addition to documents that verify your identity, age, or address, you may also need to provide a minimum initial deposit when opening a bank account. A minimum initial deposit is an amount of money required by the bank upfront when opening a checking account, savings account, or certificate of deposit. When opening a bank account online or in-person, you may need to provide the bank, credit union, or financial institution with specific documentation or meet specific eligibility requirements.

Certain types of accounts such as student savings, joint accounts, or certificates of deposits may have minimum age requirements or may require additional documents. It's important to understand these requirements before you proceed to open your preferred bank account. While business checking accounts generally aren't as generous as business savings accounts in the interest department, some major banks do at least pay token interest on deposits. For instance, Wells Fargo's top-tier business account is interest-bearing.

As an example, Axos Rewards Checking is an online-only checking account that offers customers a 1.25% APY. However with Axos Bank, you won't have access to in-branch customer service, and the online bank generally does not offer checking bonus for new customers. A Chase Total Checking account isn't right for everyone. Therefore, it's essential to consider both the advantages and disadvantages of getting one.

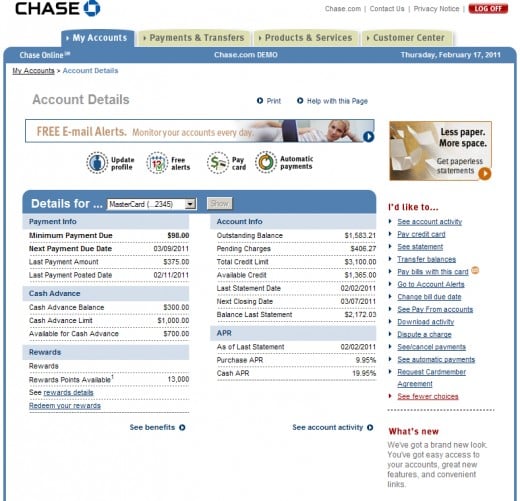

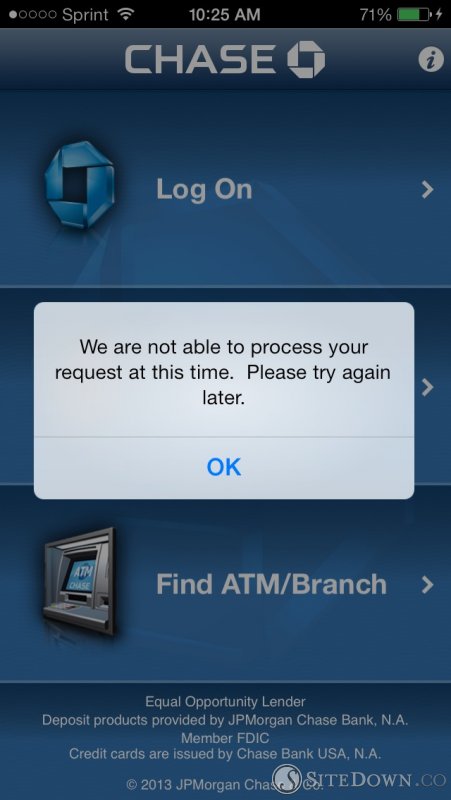

For example, the bank makes it relatively easy to get the monthly service fee waived. But if your financial situation makes it hard to skip the fee every month, you may want to look for a checking account that's truly free. Chase Total Checking® is the bank's beginner checking account that offers basic value without the special perks of premium accounts. However, new account holders can earn a $225 checking bonus when they open a new Chase Total Checking account and set up direct deposit. Additionally, this Chase checking account features a monthly maintenance fee that is easy to get waived. The Chase Bank mobile app provides a consolidated view of your relationship with the bank.

Benefits include facial recognition and fingerprint sign-in, reviewing account activity, and instantly blocking credit card transactions if you've misplaced your card. You can also send and receive money through Zelle, pay bills, and deposit checks. You'll have until the end of the business day/cutoff time to transfer or deposit enough money to avoid an Insufficient Funds Fee on these transactions. There's a three-per-day maximum for these fees (totaling $102), and they don't apply to withdrawals made at an ATM. And two of the most common ways to waive monthly fees are having direct deposits or keeping at least $1,500 as a daily balance.

However, some other banks also let you avoid it by making transactions on your account, or by having a lower direct deposit minimum than Chase allows. And Wells Fargo's basic option is slightly cheaper at $10. There is no charge from Chase, but message and data rates may apply. Delivery of alerts may be delayed for various reasons, including service outages affecting your phone, wireless or internet provider; technology failures; and system capacity limitations. However, running all of those branches comes at a high cost that's passed onto you, the customer, through high fees and low interest rates.

The savings accounts, unfortunately, offer the same kind of low rates. Plus, unlike most online-based business checking accounts, BlueVine gives you the ability to deposit checks with your business debit card, using over 90,000 eligible GreenDot locations in the U.S. Moreover, you have fee-free access to over 38,000 MoneyPass ATMs across the country. In banking, service fees or account fees are fees charged to your bank account to cover services offered by the bank.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.